Indonesia–Singapore Deepen FinTech & Digital Asset Ties with New MoU

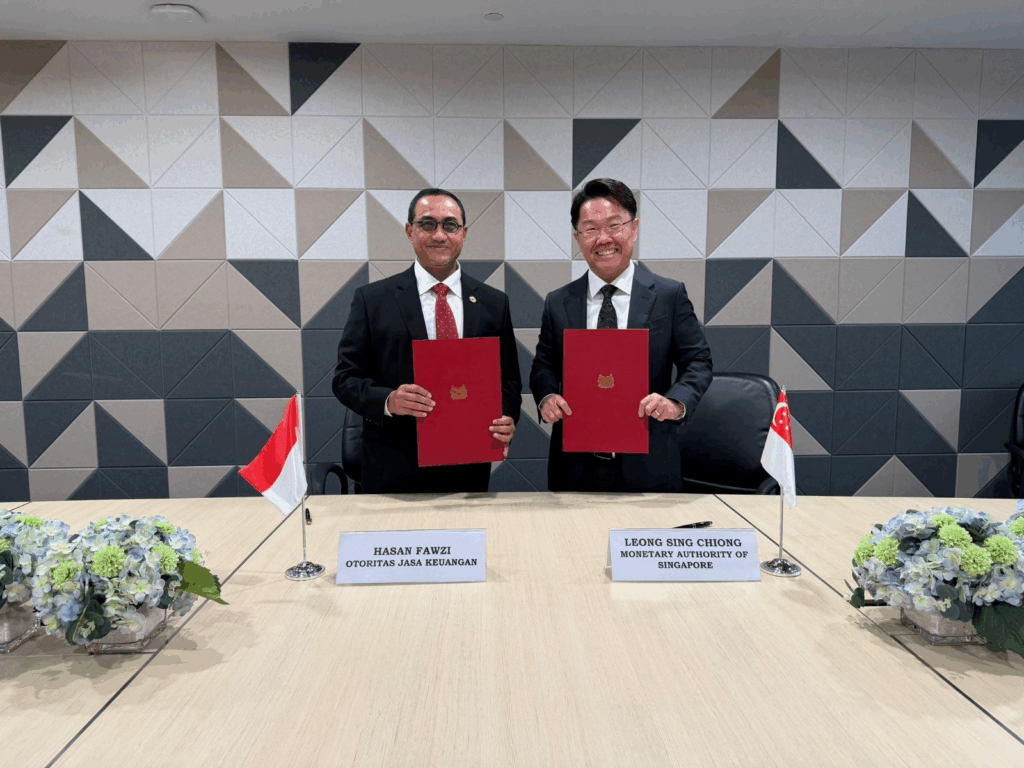

Singapore and Indonesia have taken another significant step toward strengthening Southeast Asia’s digital finance ecosystem with the signing of a new Memorandum of Understanding (MoU) on Cooperation in Financial Technology between the Indonesia Financial Services Authority (OJK) and the Monetary Authority of Singapore (MAS).

This agreement builds on the MoU first established in 2018 and reflects how quickly the region’s financial landscape has evolved. With the rise of digital financial assets, the growing use of AI in financial services, and increasing cross-border transactions, both countries recognize the need for closer coordination to ensure innovation progresses safely and sustainably.

Under the expanded MoU, OJK and MAS will:

- Share supervisory insights and best practices

- Strengthen industry engagement between fintech firms, financial institutions, and innovation bodies

- Refer qualified fintech companies into each other’s regulatory sandboxes

- Facilitate smoother, regulation-aligned information flow for licensed fintech operations across borders

This cooperation is particularly significant given the complementary roles both countries play within ASEAN. Singapore serves as a regional financial hub with deep institutional capital, advanced digital finance frameworks, and strong global connectivity. Indonesia, meanwhile, is one of the world’s fastest-growing digital economies, with a large retail market, rising fintech adoption, and a rapidly developing regulatory structure for digital financial assets.

Bringing these strengths closer together supports broader regional goals—encouraging innovation, improving interoperability, and creating more predictable pathways for companies building products across Southeast Asia.

MAS Deputy Managing Director Leong Sing Chiong emphasized the importance of the continuing partnership, noting the shared commitment to modernizing regional financial cooperation.

OJK Commissioner Board Member Hasan Fawzi highlighted that the MoU reflects OJK’s focus on responsible digital finance, covering areas such as digital assets, regulatory sandboxes, AI, MSME support, and consumer protection.

Read more: Indonesia Expands Crypto Asset List & Transfers Regulations to OJK

What This Means for Crypto Companies Building in Southeast Asia

As Singapore and Indonesia deepen their collaboration, the region’s fintech and digital asset landscape becomes more connected and more complex. Companies operating in payments, exchanges, tokenization, and AI-driven financial services now face opportunities shaped by two major regulatory environments that increasingly influence each other. At this stage of the market’s development, companies benefit from partners who understand both dynamics.

Indonesia Crypto Network (ICN) works with exchanges, fintech firms, and blockchain projects to navigate this transition through market-entry planning, localized execution, and regulatory-aligned strategies. As Indonesia’s digital finance framework becomes more standardized, accurate and contextual local insight is no longer optional—it’s essential.

Read more: Why Indonesia Matters for Crypto Brand Growth 2026