5 User Behavior Trends Defining Indonesia’s Crypto Market

Indonesia’s crypto market is no longer defined by headline growth alone. Drawing on insights from the 7th Edition of the Indonesia Crypto & Web3 Industry Report (2025), user behavior in 2025 reveals clear structure how people enter the market, where trust is formed, which assets are preferred, and how capital is held over time. These behaviors point to a market that is not only large, but increasingly predictable and scalable.

Gen Z Is the Structural Driver of Crypto Adoption

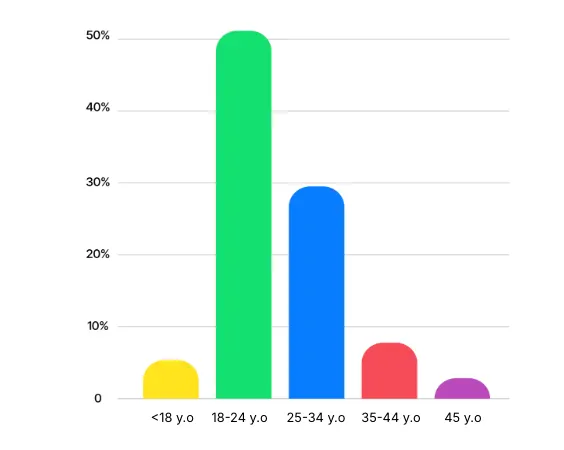

Crypto adoption in Indonesia is fundamentally shaped by young users. Respondents aged 18–24 account for 51.8% of the market, followed by those aged 25–34 at 29.8%. In total, 81.6% of users fall within the 18–34 age group.

For this demographic, crypto is not introduced through formal financial institutions. Exposure happens social through peers, online communities, and shared digital spaces. As crypto becomes part of everyday conversation, barriers to entry fall quickly and adoption spreads horizontally rather than top-down.

This creates a market with long runway. A young, digitally native base does not only adopt faster, it stays longer, learns over time, and evolves with the ecosystem.

Digital Media Shapes Awareness, Learning, and Trust

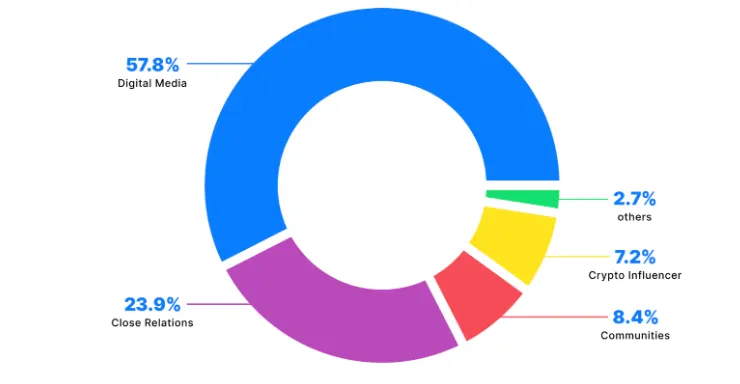

Digital platforms are the dominant entry point into crypto, accounting for 57.8% of initial exposure. YouTube, TikTok, Instagram, X, and Telegram function not just as discovery channels, but as informal education layers in a mobile-first environment.

Crypto-native media plays a central role in reinforcing trust and guiding decision-making. In 2025, Coinvestasi alone recorded an 85% increase in user interaction, reflecting how retail participants increasingly rely on familiar digital references rather than institutional messaging.

Information spreads through repetition, validation, and social proof. This reinforces predictable attention flows and creates concentrated channels where education, branding, and conversion naturally intersect.

Centralized Exchanges Remain the Default Entry Point

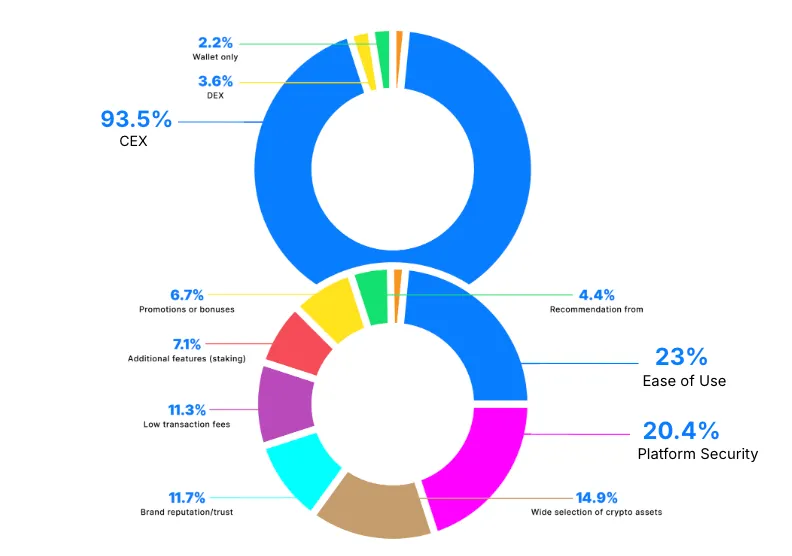

Despite global narratives around decentralization, Indonesian users overwhelmingly enter crypto through centralized exchanges. Approximately 93.5% of respondents use CEX platforms as their primary gateway.

This preference reflects practical considerations: ease of use, integration with local payment systems, liquidity depth, and regulatory assurance. In 2025, Otoritas Jasa Keuangan maintains a whitelist of 25 licensed Digital Financial Asset Traders, further reinforcing confidence in regulated platforms.

Rather than resisting structure, Indonesian users respond positively to it. Regulation acts as a stabilizer, aligning user behavior with compliant platforms and reducing friction at the point of entry.

Capital Concentrates in Large-Cap, Utility-Driven Assets

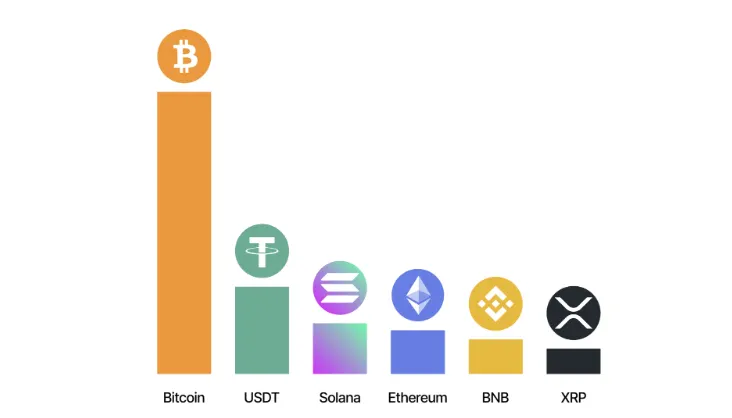

Portfolio behavior in Indonesia skews heavily toward established assets. Bitcoin leads ownership at 49.4%, followed by USDT at 19.5%, Solana at 12.1%, Ethereum at 8.9%, BNB at 6.1%, and XRP at 3.9%.

Bitcoin functions as both entry asset and long-term store of value. USDT operates as on-platform liquidity—used to preserve capital, wait out volatility, and re-enter positions without exiting the ecosystem. Exposure to other large-cap networks reflects selective participation in ecosystems with visible utility and infrastructure.

This behavior signals caution rather than speculation. Smaller-cap tokens and memecoins remain marginal, indicating a shift away from high-risk rotation toward portfolio stability.

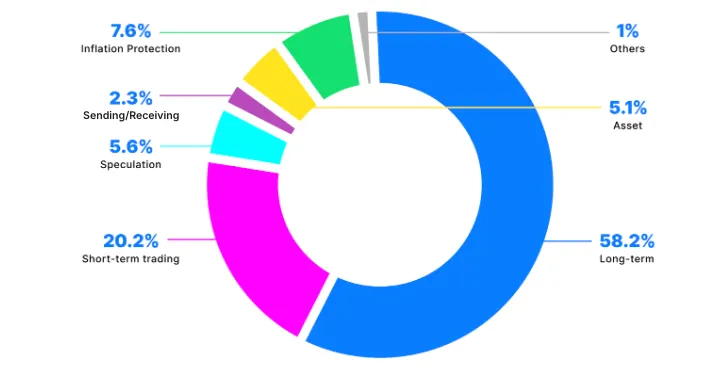

Long-Term Holding Is the Dominant User Intent

The most defining behavior emerges at the intent level. Around 58.2% of Indonesian users identify as long-term holders, while short-term trading accounts for only 20.2%.

Crypto is increasingly treated alongside stocks and gold as an asset to hold, monitor, and rebalance over time. While market cycles still influence entry timing, behavior after entry stabilizes into longer-term positioning.

This mindset supports repeat engagement, learning-driven participation, and trust accumulation. Once users are in the ecosystem, they tend to stay—adjusting strategy rather than exiting entirely.

A Market Defined by Repeatable Behavior

Taken together, these trends depict a market that is young and digitally native, socially driven yet increasingly rational, regulation-aligned rather than regulation-averse, and focused on long-term value over short-term volatility.

As the market enters a phase of structure and consolidation, entering Indonesia is increasingly less about speed and more about understanding fit, how products, platforms, and strategies align with local user behavior, regulatory expectations, and ecosystem dynamics.

In this context, Indonesia Crypto Network (ICN) serves as a local market intelligence partner, helping companies assess readiness, validate assumptions, and align their approach with on-the-ground realities before scaling in Indonesia.